North America’s Crypto Dominance: Unraveling Insights from Chainalysis

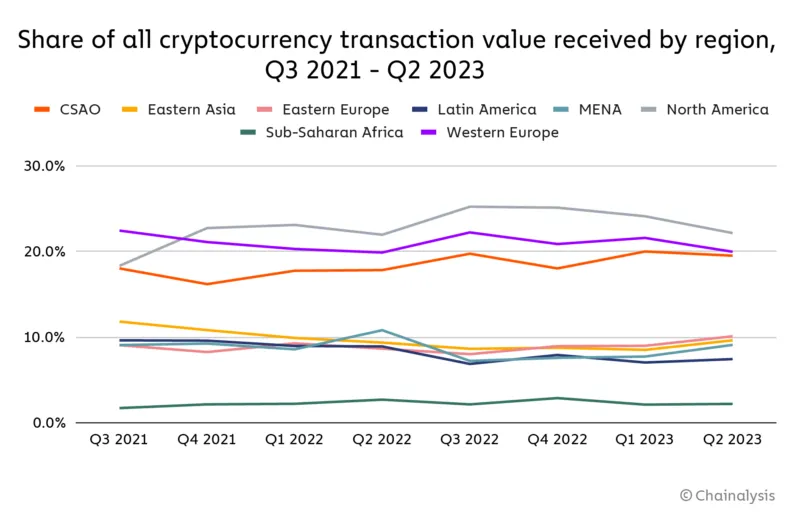

In the midst of fluctuating market dynamics and regulatory uncertainties, North America maintains its prominent position in the global crypto market, according to a recent Chainalysis report.

North America remains a powerhouse in the global cryptocurrency market, demonstrating resilience amidst regulatory uncertainties and evolving market dynamics. The region has carved out a significant niche, capturing 24.4% of the global on-chain transaction value between July 2022 and June 2023, totaling an impressive $1.2 trillion. Remarkably, over $1 trillion of this activity emanates from the United States alone, showcasing the country’s pivotal role in digital currency transactions.

This performance, underscored by a report from Chainalysis, doesn’t come without its share of complexities. North America’s share of Decentralized Finance (DeFi) activities has seen a decline, signaling a shift in market dynamics. This is attributed to many DeFi platforms’ involvement in speculative trading with assets that are highly susceptible to market downturns, resulting in a waning interest from investors.

Compounding these challenges is the lack of a comprehensive regulatory framework, creating a climate of uncertainty that has deterred some investors and businesses from fully engaging in the digital asset market. This situation highlights the importance of regulatory clarity for sustained growth within the sector.

Nevertheless, North America’s enduring resilience is evident as it secured the fourth position in the 2023 Global Crypto Adoption Index, signaling potential for recovery and growth. This also brings to the fore the critical role of regulatory frameworks in fostering a supportive environment for the crypto market.

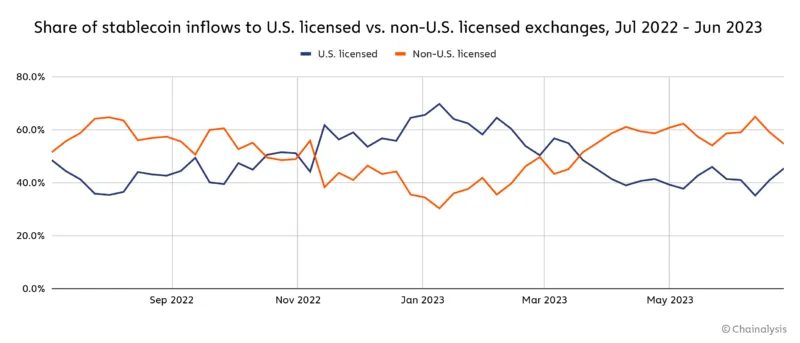

Further emphasizing the significance of institutional participation is the ongoing race for a Bitcoin Exchange-Traded Fund (ETF) in the United States, despite the US Securities and Exchange Commission’s repeated postponements of applications. Bitcoin, Ether, and other digital assets continue to operate under the pervasive influence of stablecoins, the most widely-used crypto asset, although there is a notable shift in stablecoin activity towards non-U.S. licensed exchanges.

In conclusion, the Chainalysis report paints a comprehensive picture of the North American crypto market, delineating its dominance, the $1.2 trillion in transactions, and the existing challenges, particularly in terms of regulatory ambiguities and the decline in DeFi activities. It underscores the region’s capacity for resilience and its influential role in the global cryptocurrency domain.